Use our free, multi-currency calculator suite to instantly analyze profitability (Margin, Markup), growth (CAGR), and investment viability (ROI, NPV, Break-Even)

“Eight essential financial calculators in one place, supporting global currencies.” ثماني آلات حاسبة مالية أساسية في مكان واحد، تدعم العملات العالمية

Stop Gusessing .

Start Calcuating Your Profitability and Growth! توقف عن التخمين. ابدأ بحساب ربحيتك ونموّك

Understanding Your Financial Landscape

In today’s fast-paced business environment, making informed decisions is crucial for success. Many entrepreneurs find themselves guessing their profitability and growth potential without solid data. This approach can lead to missed opportunities and uninformed strategies. By harnessing the power of financial calculators, you can stop guessing and start calculating your profitability with precision.

Six Essential Financial Calculators

We have compiled six essential financial calculators, all in one place, to assist you in managing your business finances effectively. These tools cater to various financial aspects, from simple profit calculations to more complex growth projections. With these calculators, not only can you determine your financial health, but you can also align your strategies for greater success.

Support for Global Currencies

Our financial calculators support global currencies, ensuring that you can analyze your finances regardless of your location. This versatility allows you to make pertinent comparisons and evaluations in a diverse financial landscape. Remember, the key to effective financial management is not just calculation, but continuous analysis and adaptation as your business evolves.

🧮 Calculator Feature Guide: Function, Use, and Key Distinctions

| Calculator Tool | Primary Function & When to Use It | Key Financial Distinction | Goal |

| 1. ROI Calculator | Measures the efficiency of an investment. Essential for post-campaign review to justify resources spent. | ROI measures the rate of return (percentage). Net Profit measures the absolute dollar gain. | Achieve a high percentage rate of return on capital invested. |

| 2. Profit Margin Calculator | Measures operational efficiency by showing how much of every dollar of sales converts to profit. | Margin is profit as a percentage of the Selling Price. Markup is the amount added to the Cost to get the selling price. | Maximize the percentage of revenue retained as Net Profit. |

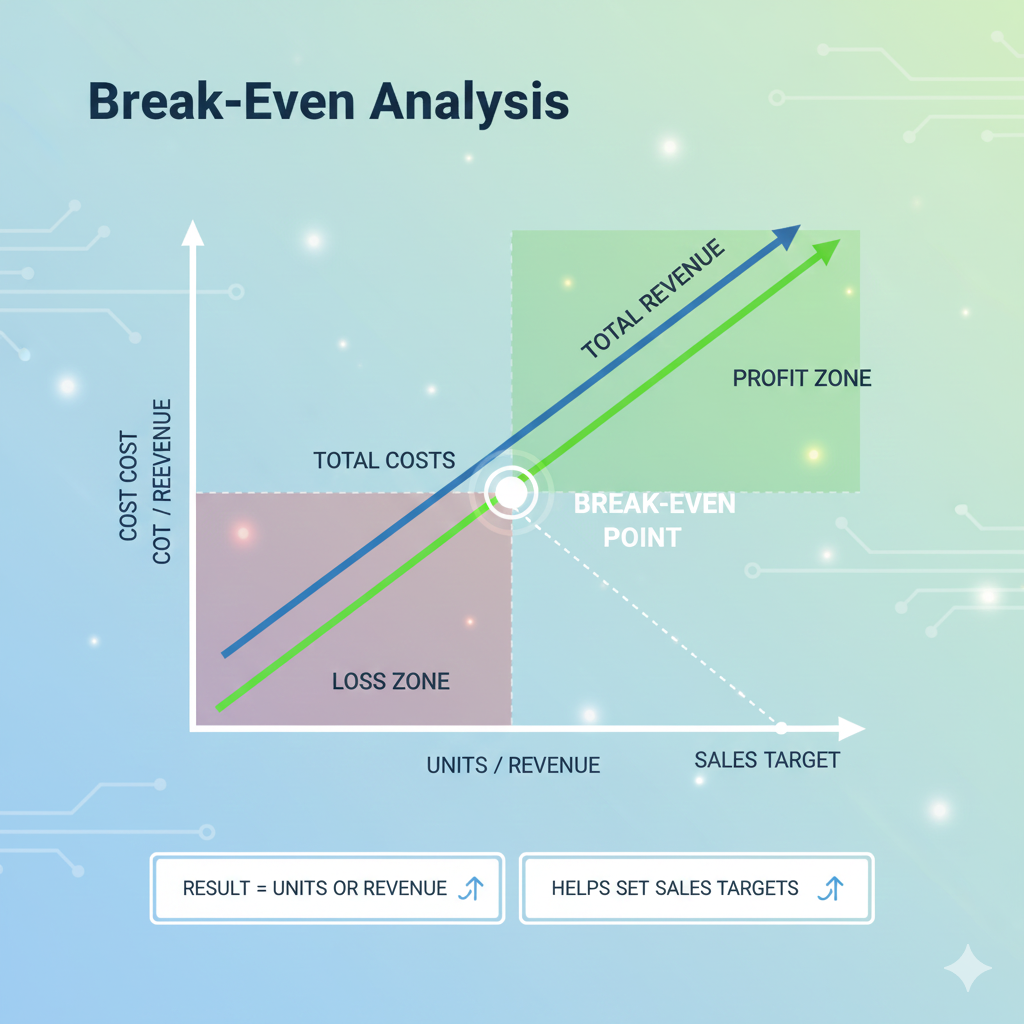

| 3. Break-Even Analysis | A risk management tool that determines the point where Total Revenue equals Total Cost (no profit, no loss). | The result (Units or Revenue) is the risk threshold. Sales above this point become pure profit. | Identify the minimum Units or Revenue required to cover all fixed and variable costs. |

| 4. CAGR (Compound Annual Growth Rate) | Provides the smoothed, annualized rate of return over a specified period. Used for benchmarking performance. | CAGR accounts for compounding and volatility. Simple Average ignores compounding, leading to potentially misleading results. | Determine the stable, sustainable annualized growth rate of an investment or business segment. |

| 5. Net Present Value (NPV) | The ultimate investment decision maker. Translates future cash flows into today’s equivalent dollar value (Time Value of Money). | Focuses on the Time Value of Money (TVM): a dollar today is worth more than a dollar tomorrow. | Achieve a Positive NPV, indicating the investment adds value to the company today. |

| 6. Markup Calculator | Determines the appropriate selling price by adding a fixed percentage to the product’s cost. Retail and E-commerce focus. | Provides immediate control over pricing strategy, often based on industry best-practice percentages (e.g., Keystone Markup – 100%). | Set a competitive selling price that guarantees the desired profit margin on every sale. |

🌎 Added Value & Trust: Global Currency Support

- How to Use the Currency Selector

- The Professional Business Calculators are built for the global economy. Our advanced multi-currency feature ensures that your financial planning remains precise, no matter where your business operates.

- Simply select your base currency from the dropdown menu (supporting 16+ global currencies) before inputting your figures.

- <strong>Special Note for International Users:</strong> Our system fully integrates commonly used currencies across the Middle East and GCC nations, including the UAE Dirham (AED), Saudi Riyal (SAR), Bahraini Dinar (BHD), and more. This seamless integration ensures your local calculations are just as accurate as any global standard, empowering your cross-border decision-making.

Frequently Asked Questions

What is the Professional Business Calculators tool about?

This tool provides a suite of powerful financial instruments for making smart business decisions. It allows users to quickly and accurately calculate crucial metrics like ROI (Return on Investment), loan payments, profit margins, and more. It’s designed to bring clarity and precision to your financial planning..

How much does the Professional Business Calculators tool cost?

The Professional Business Calculators tool is completely free to use! We believe in empowering businesses with powerful financial analysis capabilities without the barrier of a subscription or purchase price. Enjoy full access to all features and currency support at no cost.

What kind of calculations can I perform?

TThe tool supports a wide range of calculations essential for business operations. Key functions include:

- Loan and amortization schedules

- Profit margin analysis

- Return on Investment (ROI)

- Breakeven point calculation

- Compound interest and future value

- It also offers built-in support for 16+ global currencies

Is the calculator tool accurate for international business?

Yes! The Professional Business Calculators tool is specifically built to support global operations by including accurate conversion and calculation support for over 16 international currencies. This feature ensures that your financial planning, whether for international sales or loans, is precise and reliable across different markets.

Got questions?

Feel free to reach out.